If you don’t currently have a regular accounting process, consider starting one to catch accounting mistakes early on and prevent future issues. While making any type of entry in your books, double-check your work to ensure everything is accurate. If you catch an error along the way, fix it as soon as you can to avoid any other problems. A transposition error can cause overspending, inaccurate books, and not paying enough in taxes. Ever write down a number or amount only to realize you flip-flopped a number? This is exactly how easily transposition errors can plague your books.

Data Entry Errors

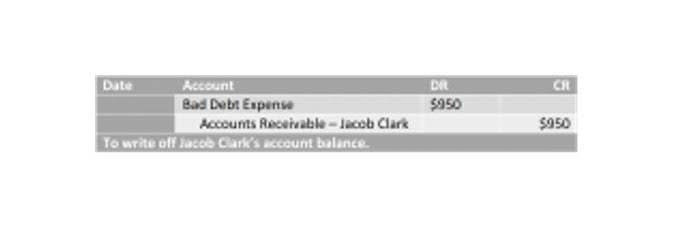

In other cases, management may try to offer explanations https://www.bookstime.com/ that suggest the error is just a change in estimate, not requiring retrospective restatement. Sometimes these justifications may be motivated by factors that don’t reflect sound accounting principles. As such, the accountant must be prudent and exhibit good judgment when examining the causes of errors to ensure the final disclosures fairly present the economic reality of the situation. Sometimes these justifications may be motivated by factors that don’t reflect sound accounting principles. An accounting error of commission can occur when an item is entered to the correct type of account but the wrong account. For example is cash received of 3,000 from Customer A is credited to the account of Customer B the correcting entry would be.

Stay up to date on the latest accounting tips and training

A $100,000 error may not be material if it won’t affect the reported numbers. Financial tools like accounting software make bookkeeping simpler, but they still need attention to keep errors out of the system. Errors in your accounting software can be introduced by things like setting up your books incorrectly, not syncing with third-party applications, or failing to check work that’s been automated. Entry reversal throws off the accuracy of your books and financial statements. When it comes time to balance the books, your assets include an additional amount that doesn’t exist and your liabilities are short an expense. They can often be found when preparing financial statements for the quarter.

Entry Reversal

As such, the account was under-debited by $90, while the sales account was under-credited by the same amount. An invoice issued to Sara Jason for $4,760 was entered into the sales book at $4,670 and posted to the ledger accordingly. An error of original entry occurs when an incorrect amount is posted to the correct account.

- A small painting company receives $500 from a client in payment for an invoice.

- Adding a journal entry may be enough to correct an accounting error.

- Each time you review your books, be on the lookout for accounting errors.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- Errors that affect the trial balance are usually a result of a one sided entry in the accounting records or an incorrect addition.

- Errors in your accounting software can be introduced by things like setting up your books incorrectly, not syncing with third-party applications, or failing to check work that’s been automated.

Rectification of Errors can be addressed by answering the questions of what, why, and how. By debiting the same amount to a suspense account, the balance of the suspense account is reduced to that extent. Earlier, it was mentioned that some errors are disclosed by the trial balance, while others are not. Therefore, in this article, whenever we refer to rectification of errors, we mean unintentional errors. For example, stock may be https://x.com/BooksTimeInc recorded at market price, which is higher than the cost price, to increase the current ratio and to create confidence among creditors.

Omission errors

- Even with automation and easy-to-use accounting tools, bookkeeping mistakes can happen.

- (1) In recording the sale of a non-current asset, cash received of $33,000 was credited to the disposals account as $30,000.

- Get up and running with free payroll setup, and enjoy free expert support.

- While making any type of entry in your books, double-check your work to ensure everything is accurate.

- It’s oh-so-important to hold onto certain receipts when you run a company.

- Preparing correcting entries is actually easy once you know the thought process behind why we prepare them.

Leaving transactions unmatched can also prevent you from realizing that your business is missing money. More importantly, under-compensation in particular can hurt your relationship with employees. Employees want to correction of book error trust they will be paid correctly and on time. Too many incorrect paychecks can break trust in your accounting system or your business as a whole.

- The way around this is to add backdated correcting entries.

- That supplier also had a balance outstanding owed to Michelle of $500.

- To help find errors in your books, have someone else review your work.

- One of the classifications is on the basis of disclosed errors and undisclosed errors.

- It’s better to act preventatively and have a system in place to enter each transaction.

- Record entries in your books regularly to avoid any issues (e.g., every week).

Would you prefer to work with a financial professional remotely or in-person?

Our prime focus is on unintentional errors, which occur at the clerical level during the normal course of recording, classifying, posting, casting, and so on. Rounding a number off seems like it shouldn’t matter but it can throw off your accounting, resulting in a snowball effect of errors. People can make this mistake, but it can also be a computerized error. To fix the entries, you must offset the original general ledger entries. When an entry is debited instead of being credited, or vice versa, this is an error of reversal. You are less likely to let an accounting mistake slip through the cracks if you have someone else reviewing your books.